Payment Methods overview

Accepting more payment methods helps your business expand its global reach and improve checkout conversion.

Whether you want to improve conversion in your domestic market or expand globally, surfacing relevant payment methods with your customers is key. But, depending on the nature of your transactions and where your customers are located, certain payment methods may or may not be relevant.

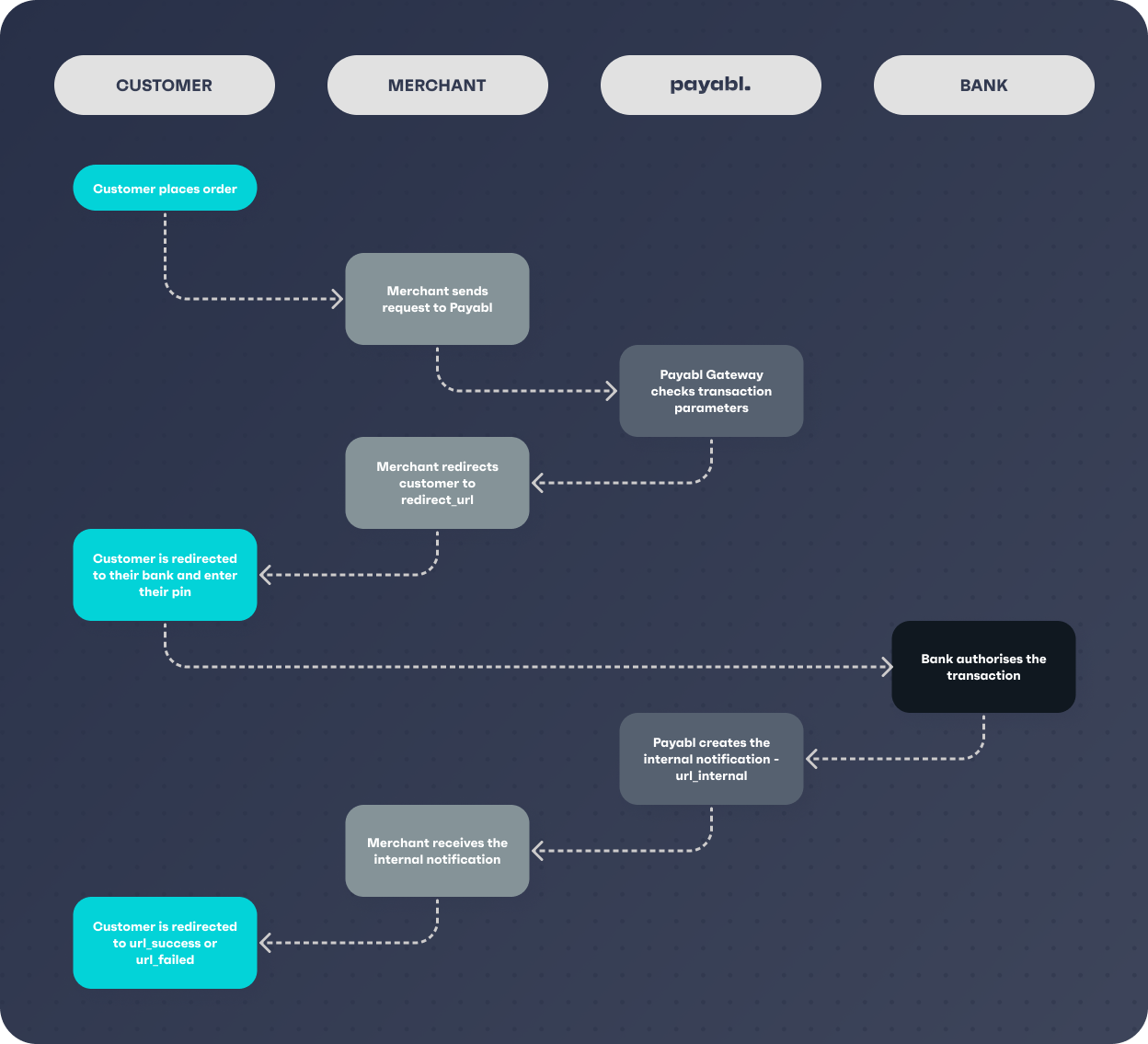

Transaction Flow

In this section, we will explain how payment method transactions flow works within payabl. payment gateway.

Before you make a transaction with one of the payment methods, please make sure that it is activated in the payment gateway before the implementing procedure.

Step 1: You need to send a transaction request to the payabl. system with all required parameters. To make a transaction request you need to use pre-authorization.

The payment gateway requires three extra URL specific parameters:

- url_success

- url_failed

- url_internal

Step 2: The payment gateway checks the parameters and sends a response to the merchant with the redirect_url parameter. The transaction has pending status now.

Step 3: Now you should redirect the customer to the redirect_url. Please note that the redirect_url is encoded. So, before redirecting the customer, you need to decode it correctly. In bank/customer’s financial institution the customer will provide her PIN (or password) to complete the transaction.

Step 4: An url_ internal will be sent to you and the customer will be redirected to the url_success or url_failed.

Step 5: At this step, the transaction process is finished.

The gateway will calculate the signature by using your secret and send it as HASH in the notification. You can use the signature to verify the source (in this case payabl. gateway) of notification.

The list of payment method IDs

You can find the list of payment methods with corresponding IDs here.

Updated 4 months ago